The FAFSA for the 2021 school year will be available on October 1. The earlier you file, the better your chances of getting some of the money colleges allocate for financial aid. In order to help parents understand the FAFSA and answer some of your questions, this week is FAFSA week.

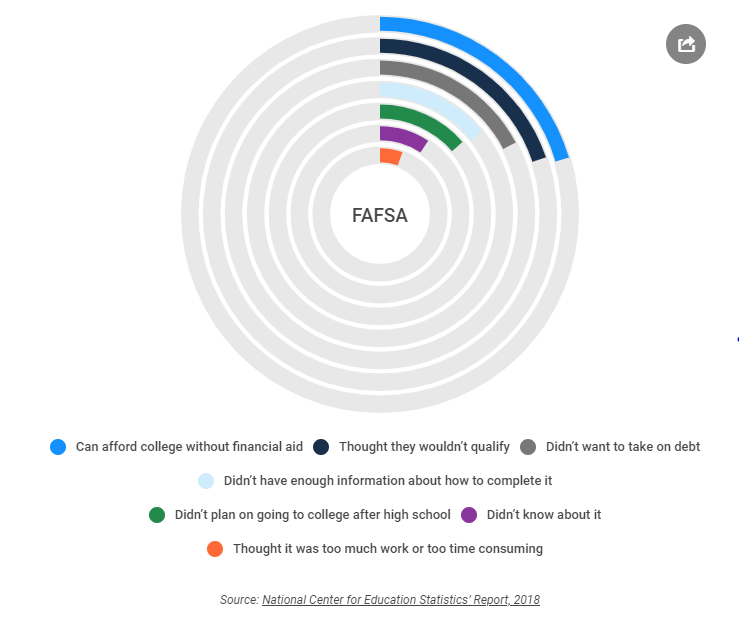

Surprisingly, many families don’t even take the time to complete the FAFSA. The most common reason is they believe they won’t qualify for financial aid; but nothing could be further from the truth. Most students receive some form of financial aid. If you don’t file, you could be missing out on some of that aid.

Here are 10 reasons to file the FAFSA:

1. College is expensive

Even if you can afford to pay for your child’s education, it’s expensive. Why would you pass up an opportunity to help with some of the cost?

2. It’s FREE

That’s right. It’s completely free to complete the FAFSA. You’ll spend some of your time completing the FAFSA and you could get thousands of dollars of financial aid in return. So one could say, it’s BEYOND free–they pay you!

3. Getting help is easy

If you get stumped, help is available. You can use the online help tool, submit a question on social media, or call the help number. You can even access the Help Center where you will find answers to their most-asked questions. Many schools even host a FAFSA day where they offer help to parents and students on how to complete the free form.

4. FREE money could be waiting for you

According to a recent Reuters article, about 1.8 million lower income undergraduates who might have qualified for aid neglected to file the FAFSA and missed out on financial aid. No matter what your income level, you should file the FAFSA because there is more money out there to be awarded than just need-based aid.

5. Federal aid

The federal government provides over $80 billion dollars in grants, loans and work-study programs every year. The only way to get Pell grants, , Stafford loans, Parent PLUS loans and other federal aid is by submitting the FAFSA. Federal loans offer the best interest rates and repayment terms for student borrowers and are superior to private student loans.

6. State aid

FAFSA is the gatekeeper for state financial aid programs. Each state’s programs are different but they all require the FAFSA to distribute the funds. Check with your state’s higher education agency for deadlines and requirements. In some states the financial eligibility ceilings are much higher.

7. Institutional aid

Colleges and private scholarship sponsors offer billions of dollars in financial aid. Even if you don’t have financial need, you may be eligible for these awards. Some school and private scholarship programs are specifically designed for students who were rejected by federal financial aid. Some schools will not award merit aid unless you complete the FAFSA.

8. Scholarship applications ask if you’ve applied

In addition to the aid that a student may receive from federal and state agencies, many scholarship applications include a box to check asking whether the student has submitted a FAFSA. According to Monica Matthews of How to Win College Scholarships, “Scholarship providers want to know that the student is doing everything possible to get financial help in paying for college and submitting the FAFSA is a very important step in the process.”

9. You have two or more children in college

With two in college, your expected family contribution (what the parents can afford to pay) drops by 50%. Even if you didn’t get financial aid with the first, file the FAFSA because having a second child in college can net you some financial aid.

10. You want to claim a “piece of the pie”

Look at it this way: FAFSA is the ONLY way to be considered for federal, state and college financial aid. Even if you don’t NEED the aid you still want to get it. Who doesn’t want FREE money?