It is easy to be lured in getting a credit card when you are in college. This is due to the expenses that you need to pay and the limited amount of money that you have.

Getting a credit card won’t be a problem if you know you are able to repay what you have borrowed. If you have a part-time job, go ahead and get one. Without an income source however, getting a credit card would be very risky.

Aside from the risk of not being able to pay your debts, you also place yourself at risk of a possible credit card fraud. A lot of naïve college students have fallen victim to credit card scammers. These are people who will do everything just to take your money away from you.

They have employed different strategies aimed at fooling people to provide their credit card information or online account passwords so they can make use of the credit card as their own. You can only imagine how devastating it would be if you are a victim of this scam.

If adults who have full time jobs have a hard time facing this kind of problem, you don’t want to imagine what could happen to you considering that you don’t even have a job. This is why you really have to stay protected. With the right knowledge on how to fight against these scammers, it is easy to stay away from them.

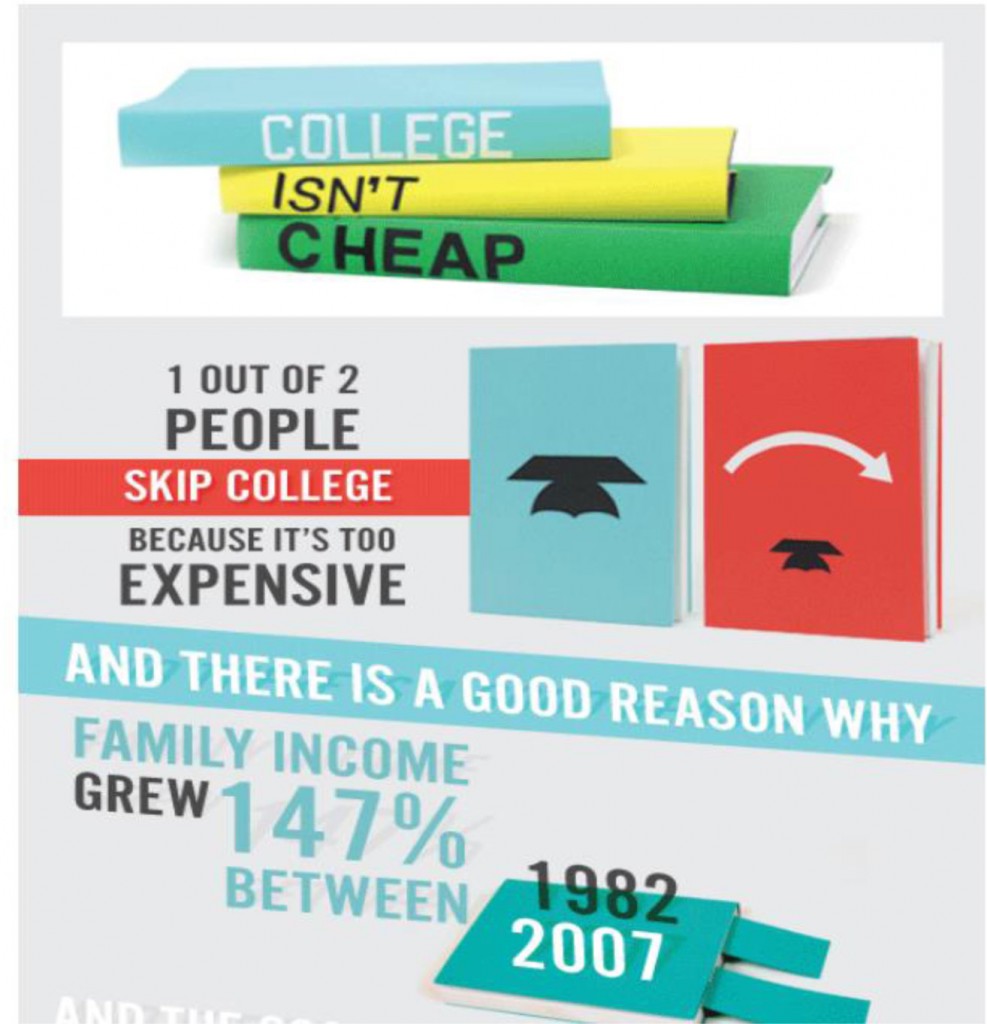

Below is an infographic giving you more information about credit card fraud. It also provides tips on how you can keep yourself protected against these bad people. You need to do everything so they won’t lure you into their scams and eventually report them to the authorities.