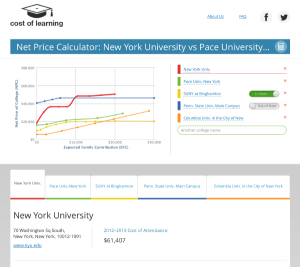

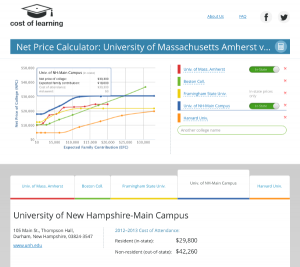

CostofLearning.com, the website providing transparency into the true cost of college via its universal net price calculator, released research findings assessing the accuracy of more than 100 well-known public and private college net price calculators. Published on the Cost of Learning blog, the analysis details which colleges under-estimate and over-estimate their true cost of college.

CostofLearning.com, the website providing transparency into the true cost of college via its universal net price calculator, released research findings assessing the accuracy of more than 100 well-known public and private college net price calculators. Published on the Cost of Learning blog, the analysis details which colleges under-estimate and over-estimate their true cost of college.

For this research, Cost of Learning used the net pricing data the universities submit to the Department of Education’s Integrated Postsecondary Education Data System (“IPEDS”) and compared that to the data found on each college’s net price calculator.

“This is the first time anyone has merged these two data sources and the results are surprising,” said Jimmy Becker, CEO and Founder of Cost of Learning. “Unfortunately, some of these calculators aren’t providing accurate information.”

The findings show state universities seem biased in favor of being conservative and over-estimating the net price of college while private colleges seem biased in favor of under-estimating prices. In some cases, these private colleges are under-estimating their pricing by thousands of dollars compared to the actual reported IPEDS data. (Editorial note: please see the blog for a full list of universities and the data.)

“Families depend on the college net price calculators to make decisions about which schools they can afford. Schools that over-estimate may discourage low-income families from applying to outstanding schools,” added Becker. “For the colleges that under-estimate, the risk is that families may have an unpleasant surprise when they receive the acceptance and award letter.”

To find out which schools over-estimate and which schools under-estimate costs, readers can read the blog or visit CostofLearning.com where they can also compare net pricing for more than 1,500 colleges and universities.

____________________

About CostofLearning.com

Based in Boston, MA, Cost of Learning’s mission is to enable families to make well-informed financial decisions about the true cost of college. With CostofLearning.com, the company is bringing actionable, clear, and simple information to what is currently a challenging and stressful process for many families. College is too expensive and the financial aid system is too complex for most of families to easily navigate. CostofLearning.com is making it easy for families to determine their true net cost of college and compare those prices across a range of colleges. With this information, families can make better choices determining which college is best suited and most affordable for them.