Last night in the #CampusChat discussion we were talking about moving into college and what to pack. One participant stated she took her whole life with her to college because she never planned to move back home after college graduation; and to her credit she did not.

Last night in the #CampusChat discussion we were talking about moving into college and what to pack. One participant stated she took her whole life with her to college because she never planned to move back home after college graduation; and to her credit she did not.

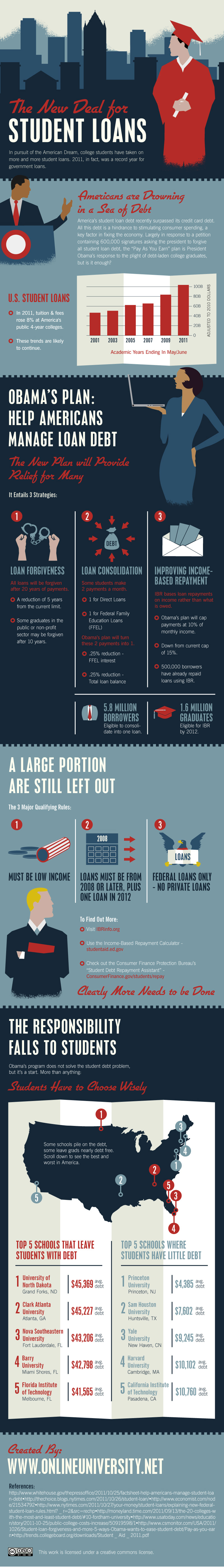

Most parents believe (or hope) that once their student goes off to college they will only be temporary visitors at home. We often talk about getting into college, but rarely discuss what happens after graduation. Unfortunately, in today’s economy, many students are forced to move back in with their parents after they graduate. For those boomerang students, the top two reasons are no job or job prospects and too many student loans exceeding their expected income.

These reasons alone make it important for parents to be involved in the financial decisions that their students make related to the college they choose and the loans they choose to incur while attending. Of course your student may WANT to go to an expensive private college, but can you, as a family, afford it? Is your student prepared for the ramifications of taking out massive student loans and not being able to repay them?

Three scenarios

After the student returns home three scenarios usually play out.

Scenario One

Your student returns home and still can’t find a job with their college degree. After weeks of depression and frustration, they make the decision to attend graduate school. Since it’s expensive, they opt to take out graduate student loans to supplement the financial aid and provide living expenses. After they complete their graduate degree, they are able to gain employment and begin paying back their loans.

Scenario Two

Your student finds a minimum wage job, defers their student loans and still can’t find a job related to their college degree and major. They end up working in a field that is completely unrelated to their area of interest, in a job they do not like, and are still unable to pay back their student loans. They borrowed too much and will probably never crawl out of the hole they dug for themselves.

Scenario Three

Your student returns home, finds a minimum wage job, defers their student loans and saves every penny they make while living at home. They are able to begin paying back their student loans with their savings and continue the job hunt while working full time. Many times, those temporary jobs end up being avenues to find college degree employment either through networking or company advancement.

With scenario one, if your son or daughter opts to pursue the graduate degree path, it’s critical they do their homework, research interest and payback rates, and degrees that are worth their investment. If they don’t, they could end up as the student in the second scenario with too much debt and no job prospects.

Summing it up (my opinion)

Advise your student wisely about debt, college value, and degree prospects after graduation. It’s not just a decision on which school they “like”. It’s a decision that affects the rest of their life and could have overwhelming negative consequences. Parents are key role players in this decision. It’s our job to point out the possible ramifications of their decisions and allow them to have input. But (and this is is hard) if they won’t listen to reason, you might have to be a parent. I know because I had to take that role with my daughter and her college choice. I had to be the “bad guy” and kept her from attending her first choice college. Today she thanks me. At the time, she wasn’t very happy with me–but she fell in love with her second choice college and graduated with minimal debt.

Being a parent can be extremely hard; we have to balance guidance with “helicoptering” and know when to take a stand for the well-being of our kids. It’s a difficult job on the best of days and downright frustrating on the worst of them. Helping them with the college choice as it relates to financial consequences is one of those “take a stand” moments.