In just under a month, it will be time to file your Free Application For Student Aid (FAFSA) for the 2011-12 school year. The FAFSA is the key to accessing your Federal Student Aid – including grants, work-study and Federal loans – and other valuable financial assistance. Whether or not you think your family will qualify, you should always apply for aid; you might be surprised at the results!

To help you make sure that you do everything necessary to get your college aid, below is a list of tips for preparing the FAFSA for submission. These are just the basics – there’s a much more detailed checklist at the bottom of this post.

If you have any questions, please feel free to reply in the comments and we will do our best to help you out!

Where to File

Starting January 1, 2011, the 2011-2012 FAFSA can filed online or downloaded at http://www.fafsa.gov. Some high schools may also have printed FAFSA forms available.

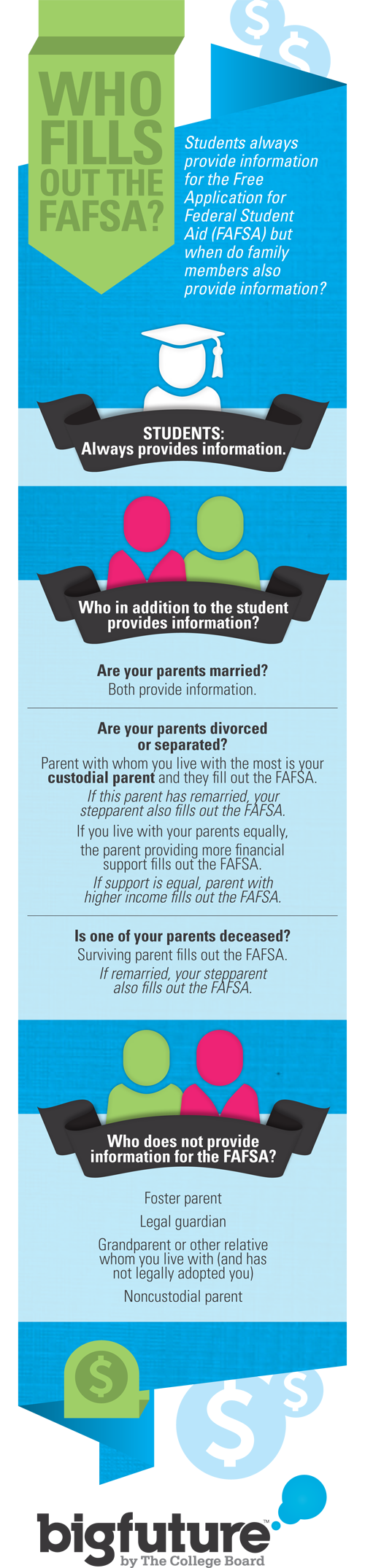

1. Determine Who Will File: You or Your Student?

The FAFSA is filed in the name of the student – the one who will be receiving the financial aid. You may submit the FAFSA on behalf of your student.

Regardless of who does the actual filing of the FAFSA, the student’s signature is always required, and if the student is considered a dependent, at least one parent must also sign.

2. Determine Dependency Status Ahead of Time

Every student who applies for financial aid with the FAFSA will either be considered a dependent or an independent student. There is a special worksheet created to determine dependency status.

To access the worksheet on the FAFSA website, click here.

NOTE: The current version is for the 2010-11 school year, but there are not likely to be major changes for 2011-12.

3. File Your Tax Returns Early

In order to complete the FAFSA fully, parents of dependent students and students who worked during the past year need to have their 2010 tax return information ready.

4. Gather Documents Before Starting

Filing the FAFSA will be much easier if you have everything together before starting. For the 2011-2012 school year, you’ll need the following documents:

- Social security and driver’s license numbers

- Student’s 2010 W-2s and tax returns

- Parent’s 2010 W-2s and tax returns (if student is Dependent)

- Bank statements

- Business financial statements (if student or parents own a business)

- Citizenship records – alien registration or permanent resident card (if you are not a U.S. Citizen)

5. Use the FAFSA on the Web Worksheet

The FAFSA on the Web Worksheet is a convenient way to organize all of the required information you’ll need to fill out the FAFSA. To access a PDF version of this worksheet, click here. (Note that the 2011-2012 worksheet isn’t available yet)

6. Apply for FAFSA PIN Now

In order to file your FAFSA form electronically online, you will need to sign it. This can be done electronically with a PIN, or you can print, sign, and mail in the signature page which will be provided to you when you complete the FAFSA. Both students and parents need to sign the FAFSA.

See the Department of Education’s FAFSA PIN website for more information.

Questions?

If you start preparing now, filling out your FAFSA on January 1st will be a breeze! If you have any questions or need additional guidance, feel free to reply in the comments below. We look forward to helping you!

******

This guest post is contributed by Jeff Sheely, who blogs about financial aid and education financing at Overture Student Loan Marketplace, where students and parents can get information or compare private student loans to make more informed decisions about how to pay for college.

He’s happy to answer your questions in the comments, or you can connect with him on Twitter or Facebook.