What’s more scarier and nerve-racking than waiting for the college decision? Opening the financial aid award package. Families all across the country are waiting for the arrival of their financial aid award, knowing that their student’s ability to attend college depends on the amount of the award.

This is such a universal anxiety among parents, television shows have written episodes around the issue. My three favorites, Gilmore Girls, Dawson’s Creek, and The Middle paint a picture of how the award letter affects college attendance.

Dawson’s Creek

Joey Potter is accepted to a high-priced private university in New England. But accepting the offer of admission depends on her financial aid package. When she receives it, they didn’t offer her a full ride. She and sister meet with the admissions counselor, who tells them that since their business is doing well, Joey doesn’t qualify for financial aid.

The counselor says, “Nearly everyone these days borrows some money to pay for college.” Joey replies, “I don’t want to do that. i don’t want to graduate with debt.”

Gilmore Girls

As graduation day approaches, Rory learns her financial aid was rejected. The irony, her mother received some financial assistance from her grandfather that altered the FAFSA results. Even though they were financially unable to pay, that money took them out of the running for aid.

Rory’s mother explains, “We didn’t get financial aid for Yale. No scholarships, no hardship money, nothing.” Devastated, Rory questions, “I don’t understand what happened. Send them proof. A bank statement. I’ll take a student loan out from the bank. That’s what banks are for.” Her mother counters, “I don’t want you to be buried by loans the day you graduate from college.”

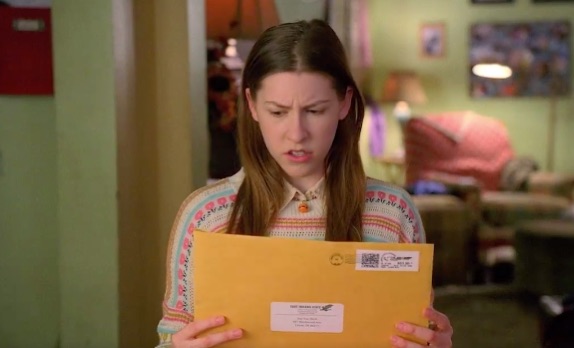

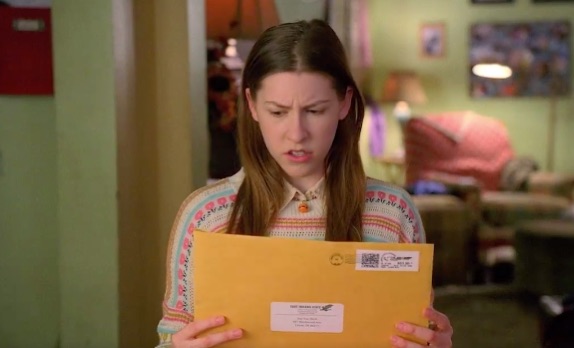

The Middle

Sue Heck opens her financial aid package and has problem deciphering it. She’s not alone. Many students and their families have difficulty understanding the award letter and don’t know how to compare awards from different colleges.

As Sue is opening the package, her parents are screaming, “What’s it say!” Sue responds, “I don’t know. Is it one year or four years?” Her father grabs the letter and immediately exclaims, “Yes! They’ve given us everything we needed. We’re poor. If we had worked a little bit harder, none of this would be possible.”

In each of these episodes, the students managed to attend their first choice college without incurring debt. Two from generous benefactors who paid their tuition and one who received a full ride. But there are underlying realities that parents must face:

1. The college decision is first and foremost a financial one–I’ve said it before and I will say it again: have the “money talk” before you apply to colleges. This avoids any disappointment if the college does not offer enough aid to cover your costs.

2. Even though a college offers admission, it doesn’t mean you will receive financial aid–Colleges use the money to attract the most desirable students. If they don’t consider that your student is desirable, they won’t offer aid or they will gap you.

3. Families anguish over the high cost of college–College has become increasingly expensive and it’s clear that the decision to attend college is not based on the education alone.

In the next few weeks I will be sharing my own personal experiences how to decipher the award package, how to compare with other colleges, and how to determine if a college is “gapping” you. Before the letter arrives, be prepared to take an honest look at your finances and have a discussion with your student about the weight the package plays in their acceptance of admission.

This past week, I’ve been discussing the financial aid awards and how they affect your student’s college choice. When those

This past week, I’ve been discussing the financial aid awards and how they affect your student’s college choice. When those