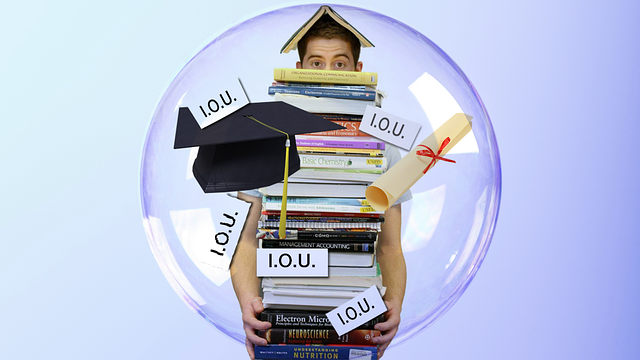

Government student loans play a significant role in providing financial assistance to students who aspire to achieve their academic goals.

Education is a key investment in one’s future, and for many students, financing their education becomes a crucial aspect of pursuing higher studies. With so much confusion these days over which government loans are best and what the difference is, I felt it was time to simplify it for you and create a list along with the specifics on each.

Following are the various types of government student loans available to students in the United States.

Federal Direct Subsidized Loans

These loans are designed to assist undergraduate students with financial need. The U.S. Department of Education pays the interest on Direct Subsidized Loans while the student is in school, during the grace period, and during deferment. Eligibility is determined based on financial need, and the amount a student can borrow is capped.

Federal Direct Unsubsidized Loans

Similar to subsidized loans, Direct Unsubsidized Loans are available to undergraduate and graduate students. However, unlike subsidized loans, students are responsible for paying the interest on these loans, even while they are in school. The loan amount depends on the student’s grade level and dependency status.

Federal Parent PLUS Loans

Parent PLUS Loans are federal loans that parents of dependent undergraduate students can use to help pay for college. These loans have a fixed interest rate and allow parents to borrow up to the full cost of their child’s education, minus any other financial aid received. Repayment begins immediately, but parents have the option to defer payments while the student is in school.

Federal Direct Consolidation Loans

Consolidation loans allow borrowers to combine multiple federal student loans into a single loan with a fixed interest rate. This simplifies repayment by having one monthly payment. While consolidation can make loan repayment more manageable, it’s essential to consider the potential loss of certain borrower benefits, such as interest rate discounts and loan forgiveness programs.

Federal Direct PLUS Loans for Graduate Students

Graduate and professional students can borrow Direct PLUS Loans to cover the cost of their education. These loans have a fixed interest rate and allow students to borrow up to the full cost of attendance, minus any other financial aid received. Repayment begins once the loan is fully disbursed, but students can request deferment while in school.

Government student loans are a crucial lifeline for many students, enabling them to pursue higher education and invest in their future. Understanding the different types of government student loans and their respective terms is essential for making informed decisions about financing education. As students explore their options, it’s important to consider factors such as interest rates, repayment terms, and eligibility criteria to choose the most suitable loan for their needs.

Don’t forget to check out all the loan repayment calculators at FinAid.org to help you determine monthly payments after graduation.